Does College Still Pay? Seven New Rules for Making a Good College Choice

On average, a college degree still offers a wage premium says a new study from the Federal Reserve Bank of New York. But those averages hide a ugly story of inflated costs, diminishing returns and a widespread worst case scenario—debt with no degree.

Dizzying choices are making things worse: the employment landscape is complex, dynamic and localized. And while some colleges are closing, there are more postsecondary options than ever for people young and old to consider.

“It’s different and more complicated now,” said Michael Horn and Bob Moesta, in their new book Choosing College. “For most students, it’s higher stakes. A mistake can have serious consequences.”

The Getting Smart team has been studying the issue of postsecondary pathways to prosperity for five years beginning with GenDIY, a JK Albertson Foundation sponsored look at post recession Millennial employment. That was followed by a Hewlett Foundation supported deep dive into the implications of artificial intelligence resulting in a 2017 report Ask About AI. The last two years, we’ve been exploring the Future of Work with the support of Carnegie Corporation.

After considering the 12 trends killing college and seven ways to fix higher education, this post provides advice to learners. Combining our work and Horn’s forthcoming book (and terrific podcast, Future U), we’ve identified seven new rules for choosing college (or not).

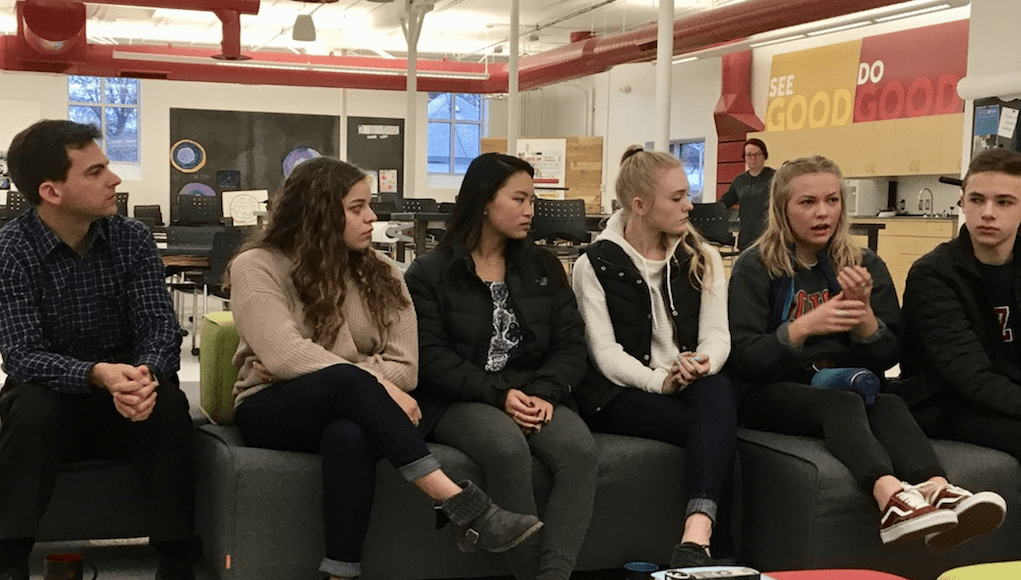

1. Get work experience in high school (and college, if you go). Ironically, the most important first step may have nothing to college. The best way to build work skills is to work. The best way to find out what kind of work you like (and hate) is to work. The best way to inform your postsecondary choices is to work.

Get whatever work experiences you can—site visits, job shadows, client-related projects, internships and summer jobs. Try to get paid where you can—you’ll need the money.

A growing number of high schools are using the Imblaze app from Big Picture to manage student internships. Over 14 million college students use the Handshake network to find internships (and then jobs) with more than 800 corporate partners.

2. Earn college credit in high school. Get as much free college as you can. A variety of college credit options are being expanded to boost student motivation and make college completion faster and cheaper. In addition to AP and IB, concurrent enrollment, stackable badges are being explored as a strategy to extend access.

3. Don’t go to college (and pay) without a purpose. College is more expensive than it’s ever been. It’s a catastrophic mistake to take on thousands of dollars of debt and drop out without earning a degree. But it’s a frequent problem—almost a third of all college graduates are underemployed and one in three college students drop out without obtaining a degree.

Horn and Moesta ask young people to step back and think about their why and then find a pathway that makes sense for them rather than just assume they should follow the crowd and take “the next logical step.” They urge young people without a clear sense of purpose to consider a gap year.

Financial writer Camilo Maldonado said, “35 years ago, it made sense to make that investment to grow and learn about oneself at college, but at the current cost of a university degree, that no longer makes sense.”

If and when you decide to go to college, do it with a clear pathway to employment, a timeline and a financial plan.

4. Consider a hard sprint to a good first job. Author and investor Ryan Craig says were in the early days of the “faster + cheaper revolution that will upend the traditional college route as America falls out of love with the bachelor’s degrees, particularly from non-selective colleges.” He urges consideration of “last mile programs” that share six characteristics: a focus on technical skills as well as job skills; intensity of applied effort in a “bootcamp” setting; demonstrated competencies rather than grades and credits; strong connections to employers; clear pathways to high demand, high wage jobs; and jobs rather than credentials as the real finish line.

Strada Education Network is a national nonprofit that has spent more than $100 million building and acquiring resources to advance “the universal right to realized potential.” Their mission is, “Completion With a Purpose.” Their advice is to get a good job after high school or find a certificate or degree program (preferably employer paid) that is a direct path to a good job. Look for “flexible, direct, cost-effective learning pathways that keep up with the emergent demands of the workforce.”

5. Choose wisely. With the big increase in cost, college is a huge financial commitment—it’s a big life decision on par with buying a house. Get good advice. Where your friend is going does not count. Play this wrong and you could end up living in a van down by the river (sorry for the Boomer humor).

Going to college matters less than in the past: 14 big companies have dropped degree requirements. Where you go to college matters less than what you can do. Fit and value are most important. Look at completion rates and debt levels for students like you. Use a service like Edmit to find the right college for you and your wallet.

6. Avoid lots of debt. Be cautious about taking on more debt than you are likely to earn in first year after graduating (even that could take a decade or more to pay off). That many mean considering a cheaper college and working or participating in work study.

Purdue has held the line on cost increases. They also offer income sharing agreements which are a better alternative than expensive student debt.

Lambda is an online coding bootcamp that trains people to be software engineers at no up-front cost. Students pay a percentage of their income after they’re employed if they’re making more than $50,000 per year.

General Assembly just announced Catalyst, a program that lets you enroll in design, tech or coding classes with no upfront cost, you pay your tuition only once you’ve secured a job earning at least $40,000 a year.

7. Make your unique contribution. Perhaps most important, use high school (and jobs and travel) to figure out what you’re good at, what you care about and where you want to make your initial contribution.

For some, the most economical path to a good paying job is what will make sense. For others, it will be putting gifts to use or working on a pressing problem that you find urgent and important.

“It’s worth embracing routes that take you off the beaten path,” said Horn and Moesta. “As you strive to broaden your options, focus on investing in yourself and learning, creating value, building productive relationships and surrounding yourself with mentors to help you navigate your path.”

If (as stated in #3) college is on that path to making your contribution—go for it, just don’t pay too much. If you can begin making a difference and do it in a sustainable way that allows to you step onto an earn and learn ladder, do that.

Just remember, it’s a marathon, not a sprint. Going to college isn’t just for high school grads. Horn and Moesta say, “You are a lifelong learner. Put higher expectations on yourself and the entities through which you learn to meet you where you are today and where you want to go tomorrow. Do not settle. Demand the value you want.”

For more see:

- How to Be Employable Forever (advice from Olin president Richard Miller)

- Guided Pathways and Meta-Majors

- Rethinking the College Pipeline: Leading University Gains Youth Badging Platform

This post is a part of the Getting Smart Future of Work Campaign. The future of work will bring new challenges and cause us to shift how we think about jobs and employability — so what does this mean for teaching and learning? In our exploration of the #FutureOfWork, sponsored by eduInnovation and powered by Getting Smart, we dive into what’s happening, what’s coming and how schools might prepare. For more, follow #futureofwork and visit our Future of Work page.

Stay in-the-know with innovations in learning by signing up for the weekly Smart Update. This post includes mentions of a Getting Smart partner. For a full list of partners, affiliate organizations and all other disclosures, please see our Partner page.

This post was originally published on Forbes.

0 Comments

Leave a Comment

Your email address will not be published. All fields are required.