Creating Digital Equity for Students Requires Community Effort

In 1977, Congress passed the Community Reinvestment Act (CRA) to counter a discriminatory practice known as red lining – the withholding of financial investments to geographic areas (marked on a map with a “red line”) based on the demographics of the population. The CRA requires federally regulated financial institutions (e.g. banks that are part of the FDIC or the Federal Reserve) to meet the needs of the communities that they serve. Four decades after the passage of this legislation, the banking community has come to realize that despite financial investments into communities, problems of economic inequity persist. Further, they recognize that a new form of red lining has emerged in the form of the Digital Divide. Both geography and socioeconomics have left millions of students and communities without access to high speed Internet, preventing them from attaining full educational and economic inclusion.

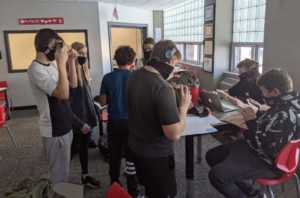

The necessity to engage in online banking presents a challenge to the banking business given disparities in both technology access and digital literacy skills. At the same time, schools, universities and libraries understand how discrepancies in digital equity have created new educational divides. Therefore, in a unique opportunity for cross-sector collaboration, the National Collaborative for Digital Equity brought members from the K-12, higher education, public library, technology, policy advocacy and banking communities together for the second annual invitational summit on digital equity and economic inclusion. Over two days, working groups wrestled with ways to address digital equity in rural and low to moderate income communities.

Despite recent FCC claims that the digital divide has largely been conquered, the participants at the national summit (as well as other digital equity advocates) perceived that the gap could actually be widening — from the homework gap that documents the lack of equitable access once students leave school to challenges of economic inclusion in a global society where not all citizens have connectivity. Over the past few decades, as urban and suburban communities as well as more affluent populations have gained faster connections and more powerful computing devices, rural populations and individuals from lower income communities lack both access and opportunity. Therefore, summit participants held working groups to address not only bandwidth and devices but also the literacy skills required to develop human agency in a digital world.

The Need for Community Investment

To address the persistent problem of digital equity in general and the homework gap more specifically, first requires funding. Members of the FDIC, Federal Reserve and Office of the Comptroller of the Currency provided information on the potential for Community Reinvestment Act (CRA) money to address digital equity for three populations: low to moderate income communities, areas impacted by natural disaster and rural communities in danger of losing their population due to lack of economic access.

According to CRA, banks need to meet the credit needs of what is known as their Assessment Area — the geography surrounding banks and deposit receiving ATMs. Though this typically occurs in the form of low-interest loans and mortgages, banks can also meet their CRA requirements through community service — such as supporting digital literacy training or donating refurbished computers, community revitalization and economic development. The latter two options could include funding broadband infrastructure projects.

For K-12 districts, CRA could become a source of funding for digital equity projects. According to the banking representatives, when districts build community partnerships to demonstrate both a strong financial investment and a broad social impact, then it can be possible to secure funding from banking institutions. For example, Capital One’s Future Edge program has invested millions of dollars to help people gain both digital and financial literacy and their Capital One Coders program connects middle school students with interest in computer science to experts in the field to build both technology skills and social connections. On the other hand, ConnectHomeUSA has created partnerships with numerous organizations to support free or low-cost technology access and digital literacy support in HUD housing communities. To date, this effort has resulted in increasing access and improving both digital and financial inclusion for 37% of participating families.

Given the challenge that schools face in ensuring that all students have equitable access outside of school, CRA presents a viable option to fund digital equity initiatives. At the summit, this conversation then merged with one of Internet access in both urban and rural communities, making the information presented by the Schools, Health & Libraries Broadband Coalition (SHLB) on the future of Education Broadband Spectrum (EBS) all the more relevant.

Connecting Students Through EBS

Even before the 1977 CRA, the Federal Communications Commission (FCC) dedicated a portion of the airwaves for education purposes. Though initially intended for television, Education Broadband Spectrum (EBS) frequencies can be used to create high-speed wireless networks. EBS then has the potential to connect millions of students, especially in rural areas. For example, a partnership between Northern Michigan University and the surrounding community in the Upper Peninsula has connected over 9,000 students.

However, the FCC has not issued any new EBS licenses in years and currently has over 4,000 of them that they are currently not releasing without petition. In April 2018, the Havasupai tribe in Arizona successfully petitioned to receive four EBS channels, allowing them to bring Internet access — and consequently expanded educational opportunity — to their community at the bottom of the Grand Canyon. Though districts could get these licenses for free, instead the FCC is considering putting them up for auction. As a result, organizations such as CoSN and SHLB have launched petitions to save EBS.

By harnessing the financial support of CRA to fund the installation of equipment for EBS — as well as other infrastructure such as hotspots and devices or even digital literacy skills training — the potential exists to make tremendous gains towards achieving digital equity. The national summit on digital equity and financial inclusion brought together participants from multiple sectors to seek out solutions to the Digital Divide. The challenge now is to continue this cross-sector collaboration to implement community-based solutions.

For more, see:

- Tackling Digital Equity in the Classroom – Strategies for Teachers

- Strategies for Tackling Digital Equity

- 10 Strategies Promoting Digital Access and Equity

Stay in-the-know with innovations in learning by signing up for the weekly Smart Update.

0 Comments

Leave a Comment

Your email address will not be published. All fields are required.